Emerging economies around the world are struggling to bring the unbanked population into the fold of full-fledged financial services including credit and cashless payments. As a migrant, daily wage labourer returns to the villages during the COVID-19 crisis and the uncertainty in where their next income or meal will come from, bringing the underbanked into the fold of banking services has never been more important. Consider the case of India alone out of Indias 220 million credit-eligible consumers, only 72 million have a credit score (CIBIL). A significant portion of those without CIBIL scores comes from the unbanked (190 million) or minimally banked (356 million no-frills accounts) rural population. In Southeast Asia, 73 percent of the regions population does not have a bank account. Naturally, a significant portion of the population around the Asia Pacific region continues to be excluded from banking services.

The gaping void in banking the unbanked has created barriers for emerging markets in overcoming poverty simply because the unbanked population can neither borrow money from a structured and safe ecosystem nor are they able to save money. Alternative data (or external data) consumer data, can help banking, financial and fintech services solve this challenge in a significant way.

The biggest challenge in truly banking the unbanked is in truly getting to know the customer

The BFSI sector puts KYC Know Your Customer at the epicentre of decision-making and customer acquisition strategies. But these are usually customers with existing credit history, social security numbers and more that enables the sector to ascertain their credit- and trustworthiness. But for much of the unbanked population, it has been near impossible to locate data sets that enable testing, analyzing, and validating these customers ability to contribute to the banking ecosystem, repay loans, or even their willingness to repay.

This is where alternative consumer data can help. Fintech companies and BFSI sector have a huge opportunity with these external data sets collected from online publishers such as location data, in order to determine risk factors about existing and future customers, especially from the unbanked sector.

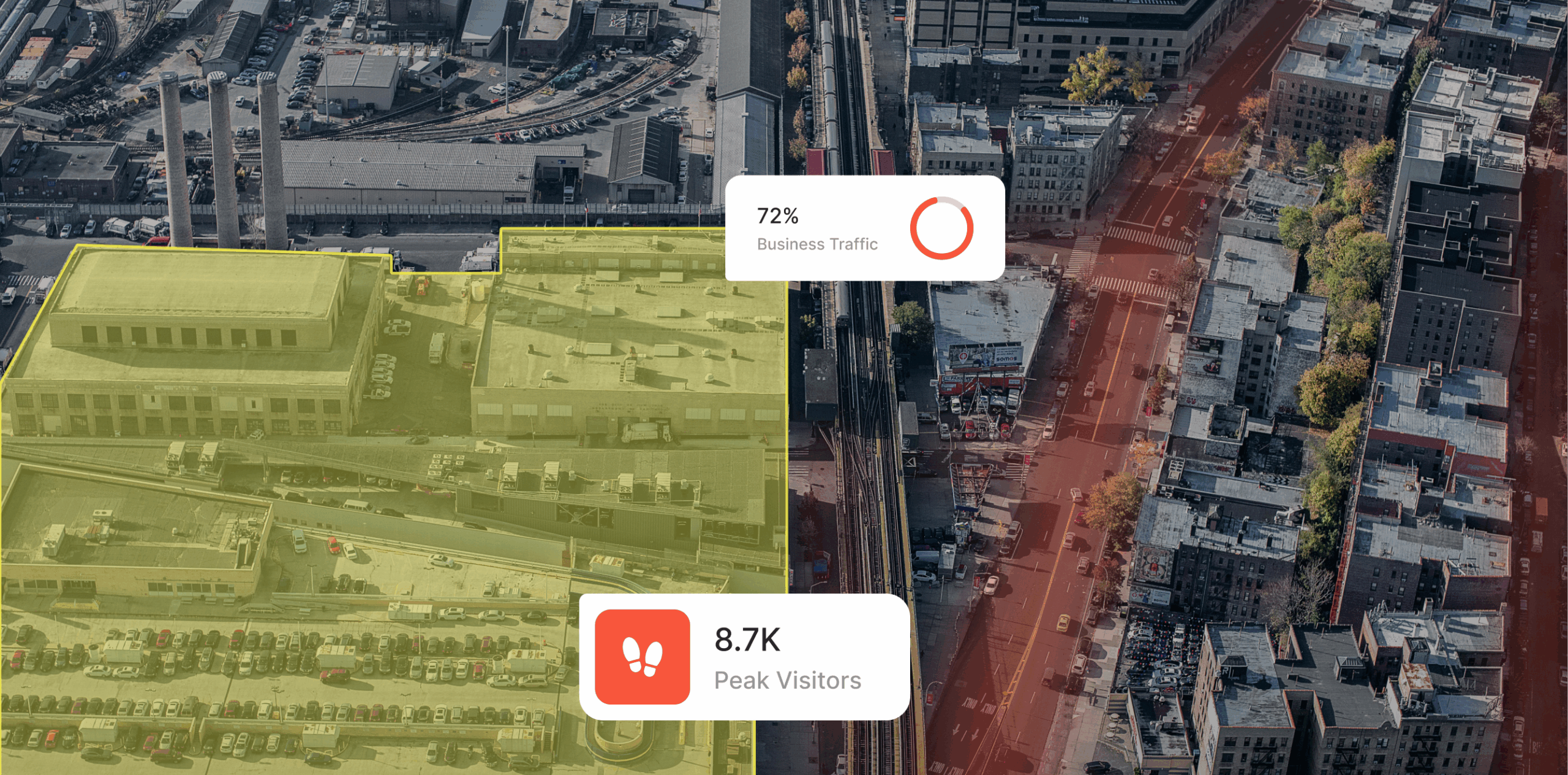

Where people go reveals who they are

The very first requirement that location and mobile-based alternative data fulfills is helping BFSI companies get access to verified home and work locations, in the absence of government-mandated address proof documents for many among the underbanked. Beyond that, these data sets also provide deep insights into customer behaviour where they go, how frequently, and what these frequented locations mean for credit eligibility among other banking services. For example, if an unbanked customer an affluent farmer from Punjab, India is at airports frequently, travels abroad, or visits luxury car showrooms, there is a good chance that his credit-worthiness is high. Similarly, if a migrant labour visits his village grocery store once a week during the current pandemic but has a full-time job in a large city, say as a security personnel, there is some data to ascertain credit-worthiness or the need for a bank account.

Beyond eligibility, these deep, holistic consumer insights help the BFSI sector shape products and outreach programs to bring the unbanked into the fold of a structured financial ecosystem. With data sets based on mobile and location intelligence in addition to the customer data they already own through their platforms and apps, future-focused banks and fintech startups are getting 360-degree view into prospective financial needs of existing and future customers. Their product strategy as well marketing communications are then based on real world as well as online behaviour and needs of their customers.

The way forward

With access to mobile technologies and ready technical know-how and infrastructure, alternative data is poised to transform the economic foundations of banking and lending in emerging markets. The BFSI space is only scratching the surface of customer-centricity with all the data sets that are now available to them. Location data solutions are showing the way. Exciting times ahead for the lofty global goal of stronger financial inclusion models!

Ready to get started? Request a demo.

You may also like