Slowly and steadily, almost like walking on eggshells, countries around the world are opening up tourism and subsequently, their economies again. The European Commission has issued guidelines, ANZ has introduced a COVID-safe travel bubble, Kerala Tourism in India is already running social media campaigns to continue to be top of mind for travellers.

This, of course, means that hotels are also opening up after perhaps one of the longest shutdowns in recent times. What is in store for them in this new normal? What tools will hotels need to navigate the complexity of winning business, consumer trust, maximizing operational expenses, and offering safe yet amazing experiences to their customers? Could post-pandemic travel be a way for luxury chains to win back customers they may have lost to new-age properties like boutique hotels and Airbnb? With safety continuing to play a key role in nearly all brand interactions, the opportunity for luxury chain hotels is unprecedented. How can they make the most of it?

The answer as usual is in data-driven insighting and decision making.

Winning consumer trust will be essential

After nearly a year of navigating life and work as a puzzle, it wouldn’t be far off the mark to say that travellers will look for truly amazing experiences, in great locations, and with brands, they can trust. How hotels market themselves in such times will be critical to winning consumer trust. But for that, they will first have to truly understand the triggers and barriers in travellers decision making in the new normal.

- Which locations did they visit before and during the pandemic?

- What kind of preferred travel experiences can hotels gauge from consumers past locations?

- What kind of content do they consume online?

- Where do health and fitness fit in the larger scheme of things for them?

- How cautious are they about travelling in the new normal? What are their top priorities?

- Consumers from which geographies are most likely to travel soon?

Being able to answer these questions will help hotel brands ramp up their offerings not only in line with government and WHO directives but also in line with consumer expectations in the new normal. Hyper-personalizing ads in line with the exact creatives and messaging that will trigger desired action from consumers will be key. For example, are your properties doing hourly sanitization of surfaces? Touch-free restaurant menus? Regular reminders for hand washing for all staff? Sanitized linen? Are consumers looking for these offerings in the new normal? If these offerings help build trust among target audiences based on their online and physical world behaviours and affinities, then it is up to hotels to communicate them sufficiently. That is the only way to win back customers in the fragile new world.

Simultaneously, this holistic advertising decision making will also mean higher ROI on ad budgets, by helping hotel marketers choose audience segments that have the most likelihood of traveling the near- to mid-term future. A win-win proposition if there ever was one.

Operational expenses that promise high ROI

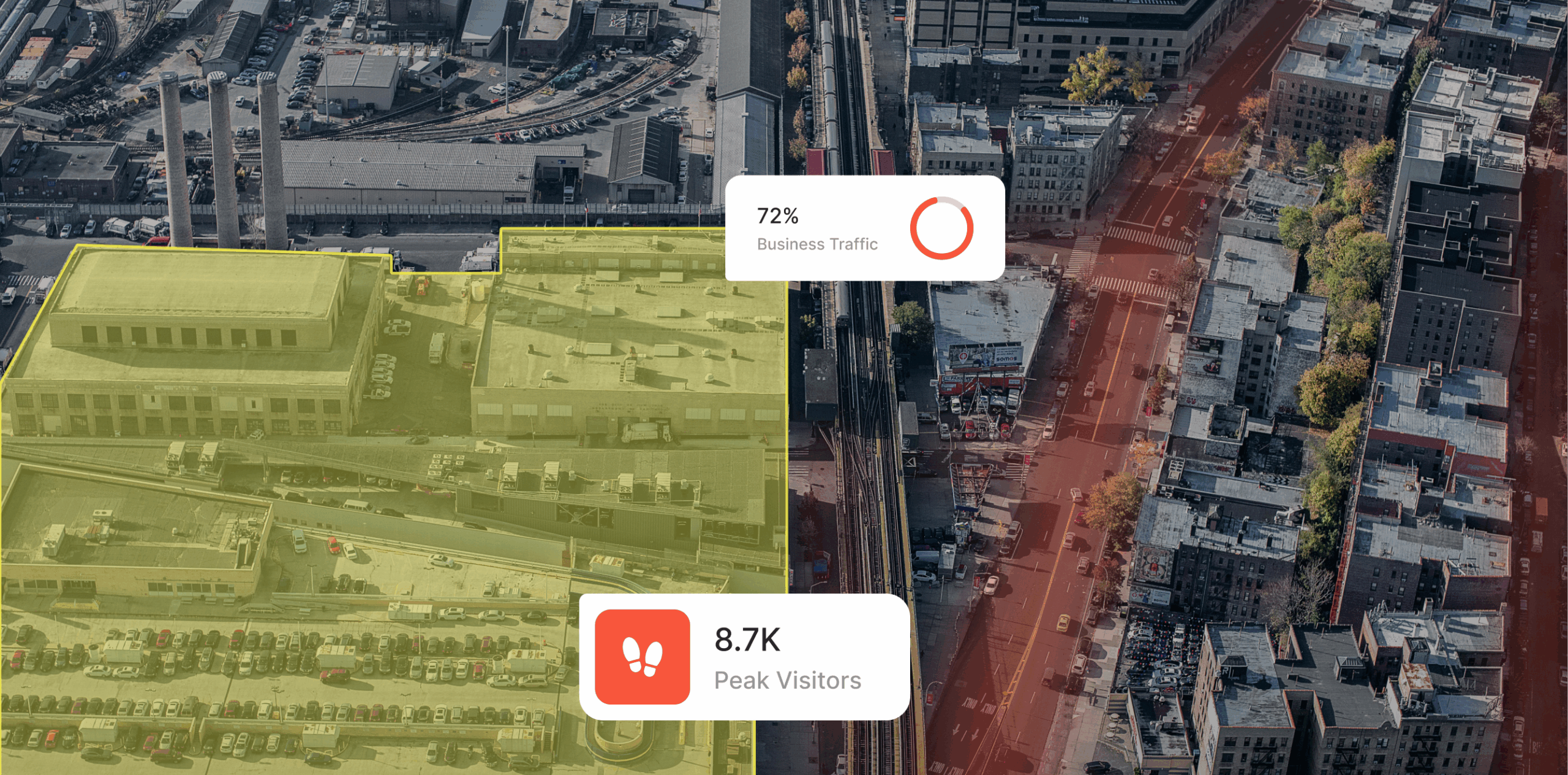

Beyond marketing, other operational expenses will decide the revenue stronghold for hotel businesses. Operational decisions now and in the future will have to be largely driven by mobility data and mobile-led consumer intelligence. This will help them make critical decisions about which properties to open first and how to staff them. Planning teams will also be able to take insight-led decisions on which services and restaurants, cuisines and meal times are likely to perform better than others in the new normal.

Understanding from fresh, post-containment lenses which locations, services, and offerings will result in maximum profits based on footfall, demographic, and geo-behavioural trends will be essential for hotel brands. Applying these real-world data-based insights into the manpower and inventory required at each property will enable better optimization of operational costs as well as higher levels of customer experience.

Chain hotels could be back with a vengeance if they play with the right data sets now!

The last few years have been difficult for luxury chain hotels. The emergence of shared economy and experience-led travel hit them hard, even more so with the 100%+ YoY growth of startups like Airbnb. However, we believe that the new normal is an opportunity for these chains to claim back their most prized possession consumer trust built over decades. With the world being what it is due to the public healthcare crisis, consumers are likely to revisit brand names that spell trust and reliability. All that chain hotels need to do is to deliver on that expectation while also making intelligent, insight-led business decisions across the enterprise. A new world awaits!

You may also like