Overview

A leading financial institution sought to enhance customer experience and optimize its branch strategy to stay competitive in a rapidly digitalizing world. They turned to Factori’s Visit Data to gain deeper insights into customer behaviors, improve branch performance, and increase engagement with in-person and online services.

The Challenge

The bank faced several challenges:

- Understanding how foot traffic varied across branch locations

- Identifying underperforming branches and potential reasons for decline

- Personalizing customer engagement based on physical location data

- Optimizing staffing and operational efficiency based on real-world customer flow patterns

The Solution

Factori provided actionable Visit Data through its advanced Mobility & People Graph, which included:

- Aggregated data on foot traffic across 200M+ global locations, including competitor site

- Insights on customer visits by location type (e.g., banking centers, ATMs, retail partnerships)

- Time-based analytics to measure peak traffic hours and customer volume

- Anonymized behavior patterns to enhance privacy while improving strategy

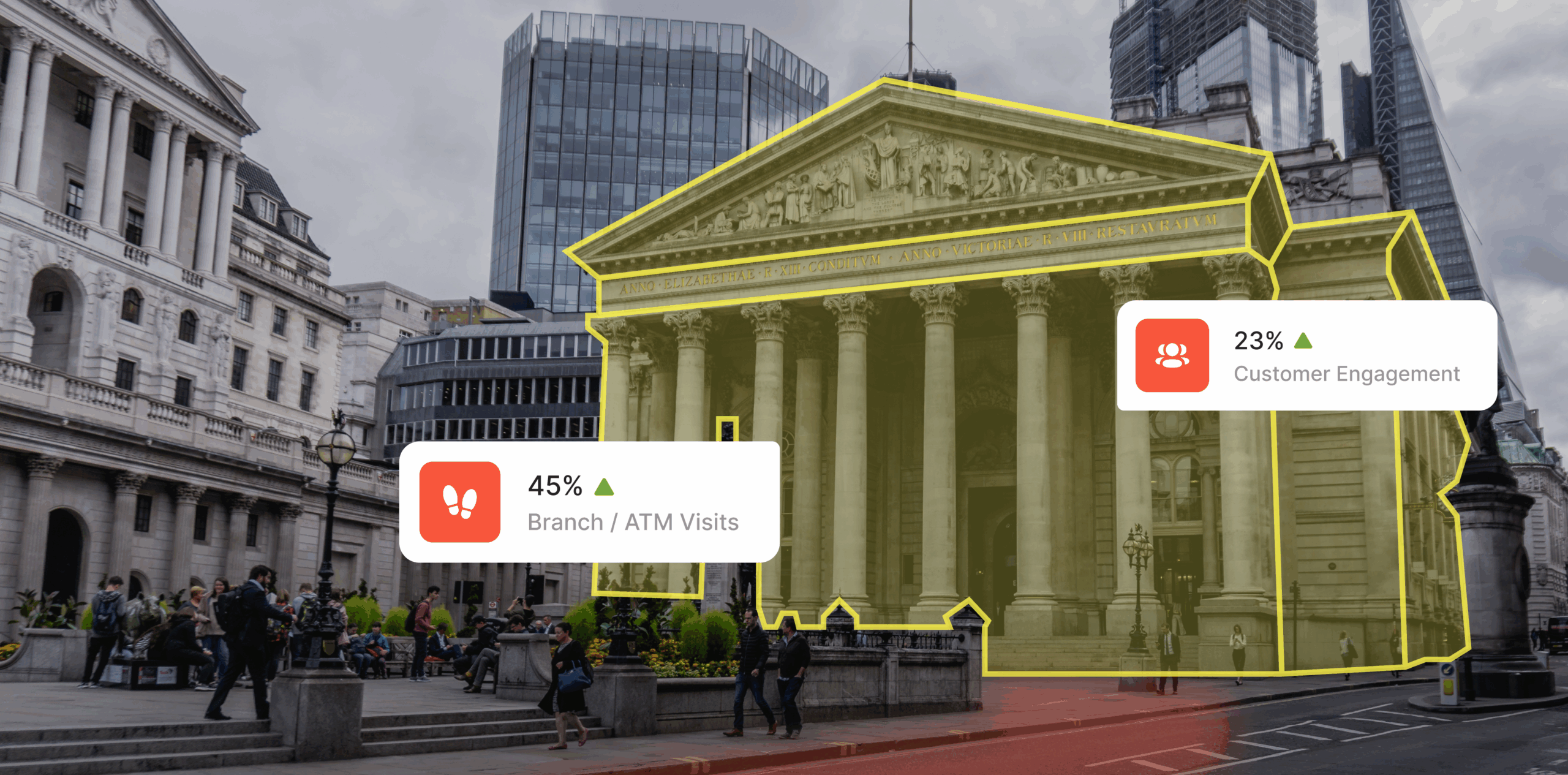

The Results

By leveraging Visit Data, the bank achieved:

- 45% improvement in branch optimization by reallocating resources based on foot traffic trends

- 23% increase in customer engagement through personalized marketing based on visited locations

- Enhanced staffing efficiency, reducing wait times and improving service delivery

- 5% increase in foot traffic to key branches, as targeted offers drove more in-person visits

Why It Worked

Visit Data helped the bank create a holistic view of its customers’ behaviors, both online and offline, by:

- Understanding customers’ physical movements, such as when and where they visited branches

- Enabling targeted marketing and outreach based on real-world behaviors

- Improving operational efficiency by tailoring resources to demand patterns

Ensuring compliance with privacy standards while gathering key insights into customer preferences