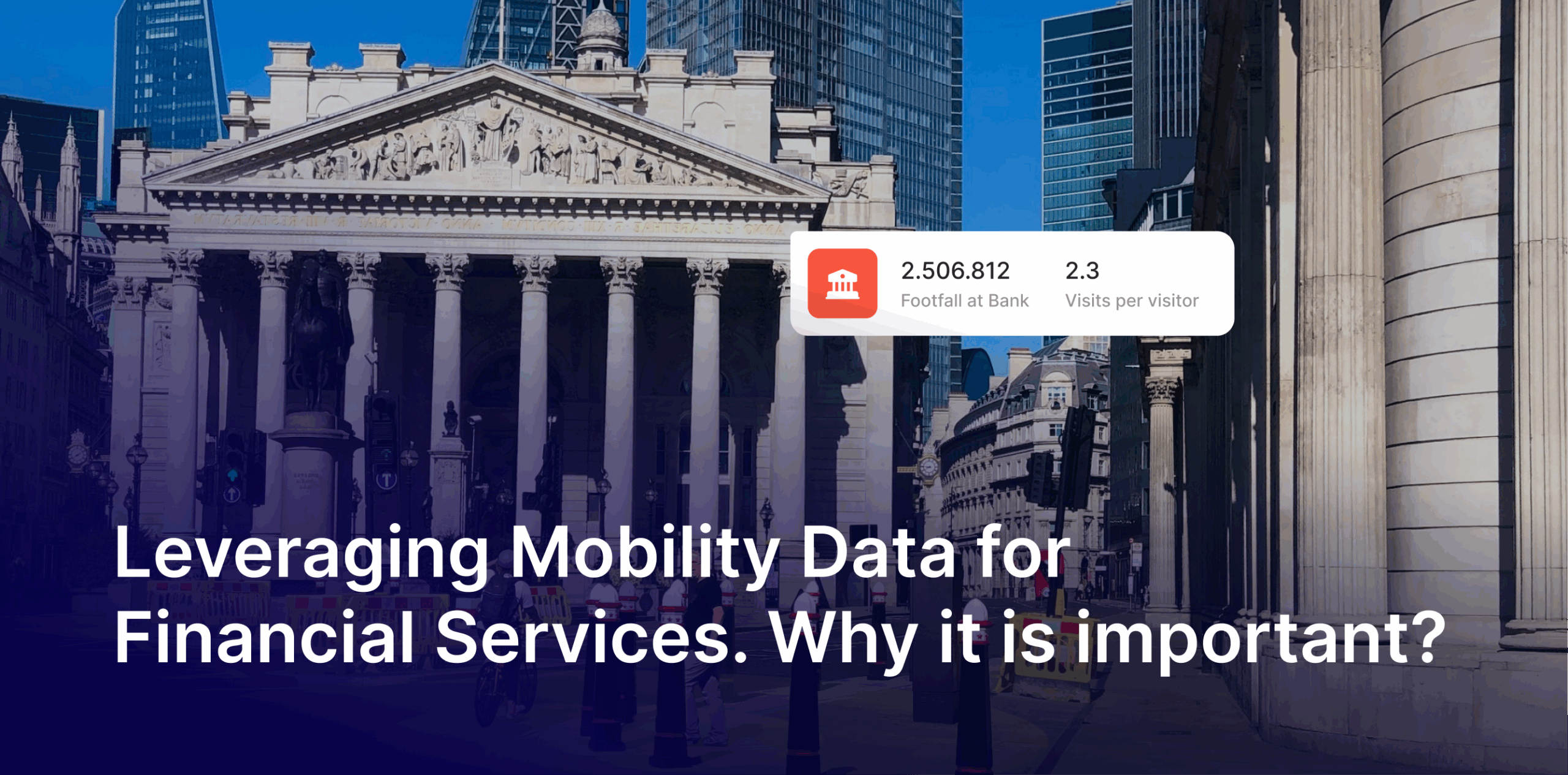

Data is the lifeblood of effective decision-making in the financial services industry. Mobility data, which tracks people’s movement across different locations, is emerging as a game changer in this sector.

At Factori, we provide mobility data that reveals how and where people move in the real world, with daily global updates. Mobility data provides real-time insights into consumer behavior, economic activity, and demographic trends.By leveraging mobility intelligence, banks and financial institutions can enhance risk management, optimize branch and ATM locations, improve investment strategies, and strengthen fraud detection systems.

You can also download a free sample of Factori’s mobility dataset to explore how real-world movement patterns can support your business decisions.

This blog explores how mobility data is transforming financial services and helping institutions stay ahead in a rapidly changing landscape. Factori’s mobility dataset helps you

1. Risk Management and Credit Scoring:

Mobility data offers a new dimension to risk management and credit scoring by providing insights into consumer behavior and economic activity in specific areas.

For example, financial institutions can use mobility data to assess a neighborhood’s economic health by analyzing foot traffic patterns, business activity, and demographic trends.

This information can be used to refine credit scoring models, helping lenders make more accurate assessments of borrower risk. Additionally, mobility data can identify areas at higher risk of economic downturns, allowing financial institutions to adjust their lending strategies accordingly.

2. Optimizing Branch and ATM Locations:

The location of bank branches and ATMs is crucial in customer satisfaction and operational efficiency. Mobility data allows financial institutions to optimize these locations by analyzing foot traffic, customer demographics, and proximity to key amenities.

For example, a bank looking to open a new branch can use mobility data to identify areas with high pedestrian traffic, a robust local economy, and a concentration of target customers.

This data-driven approach ensures new branches are located in high-demand areas, improving customer access and reducing operational costs.

3. Enhancing Investment Strategies:

Investment decisions are increasingly informed by data-driven insights, and mobility data plays a key role in this process.

By analyzing mobility data, financial institutions can better understand economic trends, consumer behavior, and market conditions. For example, suppose mobility data shows a significant increase in foot traffic in a particular area. In that case, it may indicate that the local economy is thriving, making it an attractive investment opportunity.

Conversely, declining foot traffic in a different area may signal economic challenges, prompting investors to exercise caution. Financial institutions can make more informed decisions and mitigate risk by incorporating mobility data into their investment strategies.

4. Real-Time Economic Indicators:

Mobility data provides real-time insights into economic activity, offering financial institutions a valuable tool for monitoring market conditions.

For example, by analyzing mobility data, banks can track changes in foot traffic to retail locations, restaurants, and entertainment venues, providing early indicators of shifts in consumer spending and economic sentiment. This real-time data allows financial institutions to respond quickly to changing market conditions, adjusting their strategies to capitalize on emerging opportunities or mitigate potential risks.

Additionally, mobility data can be used to monitor the impact of external events, such as natural disasters or economic downturns, on specific regions, helping financial institutions manage risk more effectively.

5. Fraud Detection and Prevention:

Mobility data can also enhance fraud detection and prevention efforts. Financial institutions can analyze patterns in foot traffic and consumer behavior to identify anomalies that may indicate fraudulent activity.

For example, if mobility data shows that a customer’s location history is inconsistent with their reported transactions, it could be a red flag for potential fraud. Financial institutions can use this information to flag suspicious activity for further investigation, helping to protect their customers and reduce the risk of economic losses

6. Customer Segmentation and Targeting:

Understanding customer behavior is critical to effective marketing and engagement. Mobility data allows financial institutions to segment their customer base more accurately by analyzing where customers live, work, and spend their time.

For example, a bank could use mobility data to identify customers who frequently visit luxury retail stores and target them with personalized offers for premium financial products. Similarly, mobility data can help financial institutions identify underserved areas and develop targeted marketing campaigns to attract new customers.

By leveraging mobility data for customer segmentation and targeting, financial institutions can improve their marketing effectiveness and enhance customer satisfaction.

7. Alternative Credit Scoring and Financial Inclusion

Mobility data is revolutionizing alternative credit scoring, especially in developing markets where many individuals lack formal credit histories.

By studying consistent mobility patterns such as daily commutes between home and workplace, lenders can infer stability, reliability, and lifestyle consistency. Borrowers with regular, predictable movement patterns are often lower-risk, even without a credit file.

This innovation allows financial institutions to extend credit to previously underserved segments, driving financial inclusion while managing default risks more effectively.

8. Merchant Performance and Portfolio Risk Analysis

Financial institutions supporting small and medium-sized businesses can use mobility insights to track merchant performance and assess portfolio risk.

Foot traffic trends, customer dwell time, and surrounding mobility fluctuations serve as indicators of business vitality.

For example, if footfall around a retail merchant drops significantly, it may signal declining sales, allowing lenders to act before repayment issues arise. Conversely, growing mobility near a store location could indicate rising revenue potential.

By integrating these insights, banks can strengthen credit risk models and make better-informed lending decisions for their business clients.

9. Real Estate and Asset Valuation

Mobility data also plays a key role in real estate valuation and asset management. Shifts in urban mobility like increased activity in emerging neighborhoods can signal areas of economic growth and rising property demand.

For example, consistent increases in mobility around a new commercial complex can indicate improving business confidence and investment potential. Real estate investors and lenders can leverage these insights to assess property values, identify undervalued regions, and reduce exposure to market volatility.

Emerging Trends in Mobility Data for Financial Services

As adoption grows, mobility data is reshaping the future of financial decision-making through several powerful trends:

1. Real-Time Analytics and Decisioning:

Banks are now leveraging streaming mobility data for instant insights. This enables dynamic credit modeling, live fraud detection, and adaptive branch management all powered by continuous, location-based feedback loops.

2. Privacy-Preserving Analytics:

With data privacy regulations becoming stricter, financial institutions are adopting technologies like federated learning and anonymization to process location data securely while maintaining analytical value.

3. Data Fusion with Transaction and Behavioral Insights:

Combining mobility data with transaction and behavioral datasets gives institutions a 360° view of their customers — revealing spending patterns, movement habits, and risk exposure.

4. Mobility as a Macroeconomic Indicator:

Mobility trends are now viewed as early signals of broader economic change. During the pandemic, for instance, mobility data provided faster insights into consumer recovery and regional resilience than traditional indicators.

Together, these trends position mobility intelligence as an essential tool in shaping the next generation of data-driven financial services.

Conclusion:

Mobility data is revolutionizing the financial services industry by providing valuable insights that enhance risk management, optimize branch locations, and inform investment strategies.

By harnessing the power of mobility data, financial institutions can stay ahead of market trends, make more informed decisions, and better serve their customers. As the economic landscape continues to evolve, the ability to leverage data effectively will be a crucial differentiator for success.

Note: Check here for Free Data Sample of Factori’s Mobility Data.

You may also like