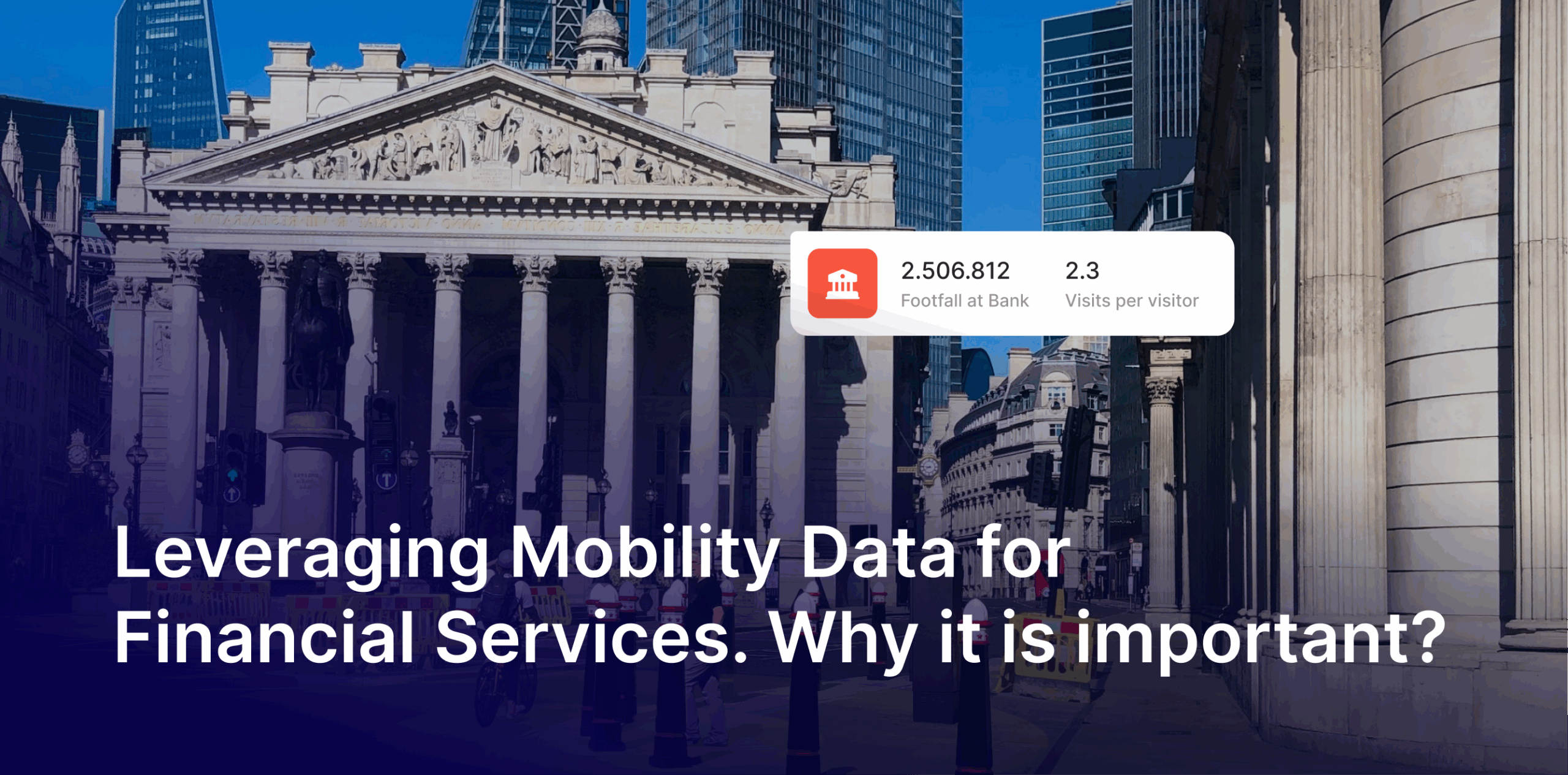

Understanding customer behavior and risk profiles is critical for making informed decisions in the financial services industry. Consumer data provides financial institutions with the insights needed to assess risk, personalize services, and predict market trends.

This blog explores the impact of consumer data in financial services and provides a key use case.

Risk Assessment and Management

Consumer data allows financial institutions to assess the risk profiles of individuals more accurately. By analyzing a combination of demographic information, financial history, and behavioral patterns, institutions can make better-informed decisions on lending, insurance, and credit approvals.

A leading bank uses consumer data to enhance its credit risk assessment process. By analyzing the financial behavior and demographic profiles of loan applicants, the bank can more accurately predict the likelihood of default, leading to better credit decisions and reduced risk exposure.

Personalized Financial Services

Consumer data enables financial institutions to offer personalized financial products and services that meet the unique needs of each customer. This personalization enhances customer satisfaction and loyalty.

A wealth management firm uses consumer data to create personalized investment portfolios for its clients. By understanding each client’s financial goals, risk tolerance, and investment preferences, the firm can offer tailored portfolios that align with their needs, leading to higher client satisfaction and retention.

Predictive Analytics for Market Trends

Financial institutions use consumer data to predict market trends and consumer behavior. This data-driven approach allows them to make strategic decisions that align with future market developments.

A financial services company uses consumer data to forecast consumer spending trends. By analyzing past spending behavior and current economic indicators, the company can predict future trends, enabling more accurate financial planning and investment strategies.

Conclusion

Consumer Data is transforming the financial services industry by enhancing risk assessment, enabling personalized financial services, and providing insights for predictive analytics. Financial institutions that leverage consumer data can make better decisions, offer more relevant products, and stay ahead of market trends.

You may also like