In the fast-paced world of finance, staying ahead of the competition requires access to timely, diverse, and actionable data.

Traditional data sources, such as financial reports and industry surveys, provide valuable insights but often lag behind emerging market trends and shifts.

This data delay can prevent financial institutions, hedge funds, and asset managers from making swift, informed decisions that capitalize on market changes.

Alternative data is a game-changer in the financial industry. By using it, financial institutions gain fresh perspectives and real-time insights that can significantly enhance financial research and investment strategies.

This guide will explore how alternative data is not just a tool but a transformative force in financial markets, its key types, and its potential to revolutionize financial analysis.

Key Takeaways from the Guide

- Alternative data provides real-time, actionable insights that complement traditional financial data, allowing faster decision-making and better forecasting.

- Types of alternative data commonly used in finance include transactional data, geospatial data, social media data, web scraping, and mobile app data.

- Financial institutions such as hedge funds, asset managers, and lenders use alternative data to assess company performance, predict market trends, and evaluate credit risk.

- Key financial use cases include hedge fund strategies, equity research, credit risk assessment, private equity due diligence, and supply chain monitoring.

- Challenges of alternative data include data integration, ensuring data quality, and navigating privacy regulations such as GDPR and CCPA.

- Selecting the right data provider is crucial, with factors like data quality, unique data sources, compliance, and scalability being important considerations.

- The future of alternative data in finance is bright, with advancements in AI and machine learning making it easier to process large datasets and gain deeper insights.

What is Alternative Data?

Alternative data refers to datasets sourced from nontraditional channels, providing unique insights that complement conventional financial data.

While traditional sources such as earnings reports and government statistics are crucial, alternative data is collected from various digital and offline activities, such as credit card transactions, satellite imagery, social media, and geolocation data.

In the financial services context, alternative data enables firms to gauge market conditions, predict economic performance, and evaluate company fundamentals before official reports are available.

This forward-looking approach can give financial analysts and investors an edge in spotting opportunities and managing risks.

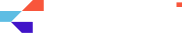

Types of Alternative Data for Financial Analysis

The financial industry can make use of the alternative data from various sources. Here are the primary types of alternative data used in finance:

1. Transactional Data

Transactional data, especially from credit and debit cards, provides a direct view of consumer behavior and spending trends.

This data is particularly useful for hedge funds and asset managers looking to assess a company or sector’s performance before earnings reports are published.

2. Geospatial Data

Geospatial data, such as satellite imagery, offers unique insights into real-world activities, such as the number of cars in a store parking lot or the flow of ships through ports.

Investors can use this data to predict supply chain health, track production, and even forecast sales volumes for retail giants.

3. Social Media Data

Platforms like Twitter, Facebook, and Instagram provide real-time information on consumer sentiment, brand engagement, and trending topics.

Financial analysts can assess public sentiment toward companies or products, making this data valuable for investment strategies and market predictions.

4. Web Scraping Data

By collecting publicly available information from websites, financial firms can gather intelligence on company pricing strategies, customer reviews, and market share.

For example, private equity firms may use this data to analyze a company’s product offering and competitive landscape.

5. Mobile App Data

Mobile app usage, downloads, and engagement provide insights into customer preferences, app success, and overall market trends.

This data is especially relevant to tech investors and venture capitalists who monitor the performance of tech companies and startups.

Why is Alternative Data Important in Finance?

The financial industry’s ability to access real-time alternative data doesn’t just provide a competitive advantage, it fuels motivation.

The immediacy of this data allows for quicker decision-making, whether it’s identifying emerging trends or mitigating risks.

In finance, alternative data helps investors and analysts see around corners—gaining insights into trends, market movements, and consumer behaviors before they fully materialize. This is crucial for maintaining a competitive edge in rapidly changing markets.

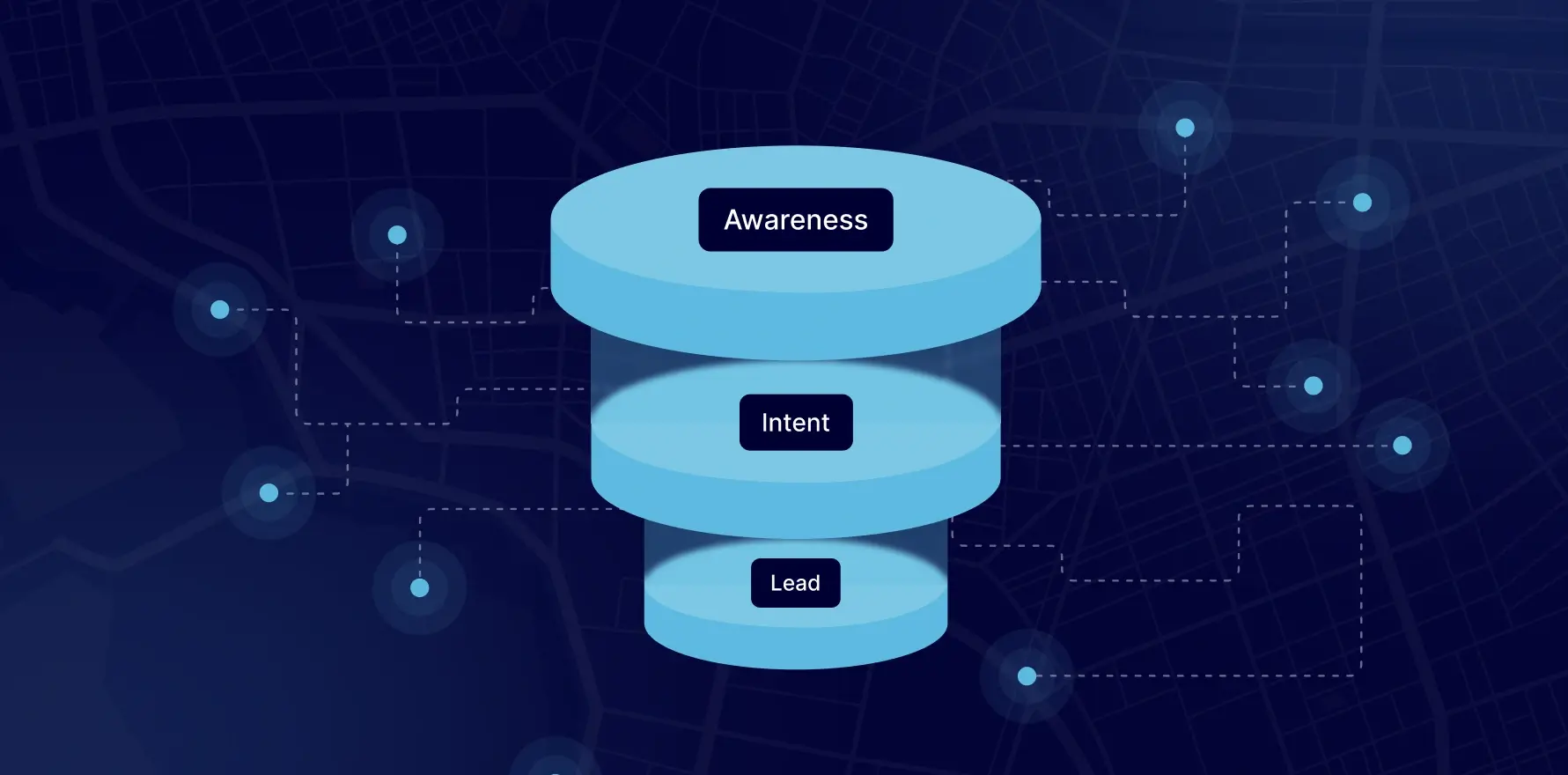

Key Financial Use Cases of Alternative Data

Alternative data’s influence spans across various functions within the financial sector. Below are some specific use cases:

1. Hedge Fund Strategies

Hedge funds leverage alternative data to gain insights into company performance before earnings reports are released.

For example, satellite images of parking lots or credit card transaction data can reveal trends in retail performance, enabling funds to adjust their investment strategies ahead of the market.

2. Credit Risk Assessment

Lenders can use alternative data, such as transactional behavior, employment history, and even social media activity, to assess an individual’s creditworthiness more accurately. This allows for more personalized lending options and reduces the risk of defaults.

3. Equity Research and Forecasting

Equity analysts use alternative data to forecast stock prices, sales, and earnings. Analysts can better understand a company’s potential performance before quarterly reports are issued by analyzing data like web traffic, social media sentiment, or shipping activity.

4. Private Equity Due Diligence

Private equity firms can use alternative data to conduct more thorough due diligence. Transaction data, web scraping, and geolocation data help investors evaluate the health of a company’s supply chain, customer base, and competitive position before acquiring.

5. Supply Chain Monitoring

Supply chain disruptions can significantly impact a company’s bottom line. Financial institutions use alternative data from IoT devices and satellite imagery to track supply chains, anticipate bottlenecks, and ensure timely deliveries.

Challenges of Using Alternative Data in Finance

While alternative data holds enormous potential, it also presents challenges, particularly for the financial industry:

1. Data Integration

Integrating alternative data into existing financial models and systems can be complex. Firms must adopt sophisticated data processing tools to merge alternative datasets with traditional data sources and derive meaningful insights.

2. Data Quality and Reliability

The accuracy and timeliness of alternative data are critical. Financial decisions based on reliable data can lead to better investment choices. Selecting data providers with strong validation processes is essential for ensuring the integrity of the data.

3. Regulatory and Privacy Concerns

Financial firms must navigate strict privacy regulations, such as GDPR and CCPA when using sensitive alternative data like geolocation or transactional information. Ensuring compliance with data privacy laws is critical to avoid legal risks.

How Financial Firms Can Choose Alternative Data Providers

Choosing the right data provider is a critical decision for financial firms. Key factors to consider include:

- Data Quality: Ensure the provider offers high-quality, reliable, timely data.

- Unique Data Sources: Access to exclusive datasets can provide a competitive advantage.

- Compliance: Providers must adhere to regulatory standards like GDPR and CCPA to ensure data privacy.

- Scalability: Ensure the provider can scale their offerings as your firm grows.

The Future of Alternative Data in Finance

As technology continues to evolve, the role of alternative data in finance will grow exponentially. Advances in machine learning and ar tificial intelligence will make it easier to process large datasets, enabling financial institutions to extract even more valuable insights.

Alternative data is no longer just a supplement to traditional data—it’s becoming a critical component of financial decision-making.

Firms that effectively integrate alternative data into their research and investment processes will gain a significant advantage in navigating volatile markets and capitalizing on emerging opportunities.

Final thoughts

The use of alternative data is changing the financial industry by offering real-time, practical insights that traditional data often overlooks.

From hedge fund strategies to credit risk assessment and equity forecasting, alternative data opens up new opportunities for financial analysis.

As more financial institutions adopt this resource, those who use alternative data will have a significant competitive edge.

Factori pioneers in offering customized data solutions to the financial industry.

Schedule a free discovery call with one of our data expert to analyse your existing data and recommend you insights to unlock your business growht using Alternative Data.

You may also like